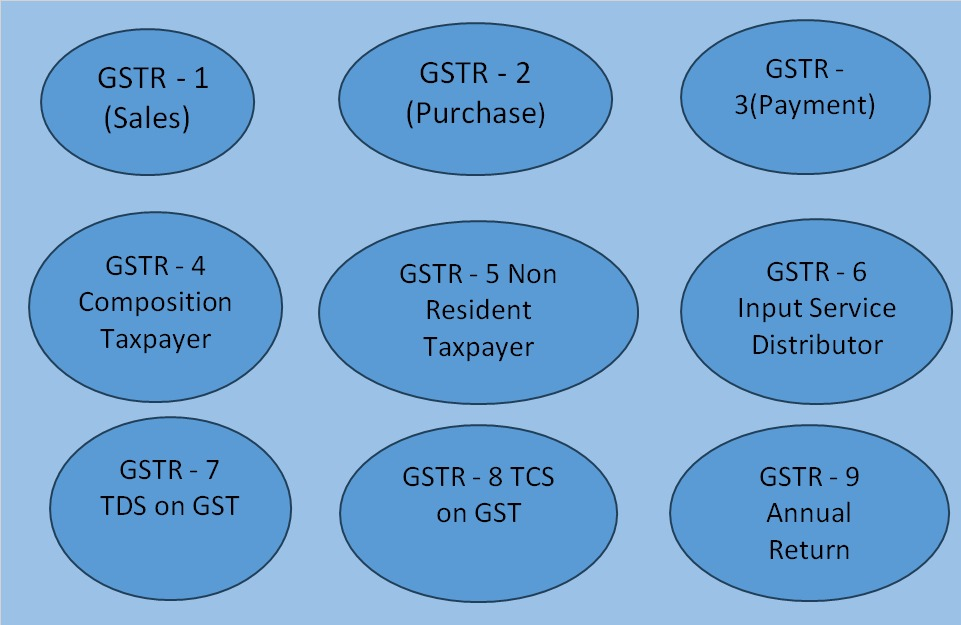

It seems like you’re asking about GST returns, likely referring to Goods and Services Tax returns. In many countries, including India, GST returns are filed periodically by registered businesses to report their sales, purchases, and the amount of GST they owe or are owed by the government. The frequency and format of filing vary depending on the specific regulations of each country.

GSTR – 1 Sales

GSTR-1 is a monthly or quarterly return that must be filed by registered taxpayers in India under the Goods and Services Tax (GST) regime. It contains details of outward supplies of goods or services made by the taxpayer during the reporting period. GSTR-1 includes information such as invoice-wise details of sales, details of exports and supplies to SEZs (Special Economic Zones), debit/credit notes issued, and amendments to previously reported invoices.

Taxpayers are required to file GSTR-1 by the 11th of the following month for monthly filers and by the 13th of the following month for quarterly filers. It’s an essential part of the GST compliance process as it provides the government with crucial information for tax assessment and input tax credit reconciliation.

GSTR – 2 Purchase

GSTR-2A and GSTR-2B are both auto-generated documents under the Goods and Services Tax (GST) regime in India, but they serve slightly different purposes.

- GSTR-2A:

- GSTR-2A is an auto-generated document that is made available to taxpayers on the GST portal.

- It is a read-only document that contains details of all the inward supplies (purchases) as reported by the suppliers in their GSTR-1 returns.

- GSTR-2A helps taxpayers verify the accuracy of the details of inward supplies before claiming input tax credit (ITC) in their own GST returns.

- Taxpayers can reconcile the information in GSTR-2A with their purchase records and take corrective actions if there are any discrepancies.

- GSTR-2B:

- GSTR-2B is another auto-generated document introduced by the GSTN (Goods and Services Tax Network) to assist taxpayers in reconciling their input tax credit claims.

- It is similar to GSTR-2A in that it contains details of all the inward supplies (purchases) reported by the suppliers, but it provides additional features and functionalities.

- GSTR-2B is generated on a monthly basis and is available for viewing on the GST portal.

- Unlike GSTR-2A, GSTR-2B includes details of eligible input tax credit available to the taxpayer after considering various factors such as ITC ineligible under Section 17(5) of the CGST Act and ITC available under the reverse charge mechanism.

- GSTR-2B is structured in a format that makes it easier for taxpayers to reconcile and take action on their input tax credit claims.

GSTR – 3 Payment

GSTR-3 is another return that was previously required to be filed by registered taxpayers in India under the Goods and Services Tax (GST) regime. It was a consolidated return that summarized the details of outward supplies, inward supplies, input tax credit claimed, tax liability, and tax paid during the reporting period.

However, GSTR-3 has also been discontinued by the government. Instead, taxpayers now need to file their returns through various other forms such as GSTR-1 for outward supplies, GSTR-3B for summary return filing, and other applicable forms for specific transactions and purposes.

GSTR-3B is currently one of the primary return forms used by taxpayers for summarizing their tax liabilities and input tax credit claims on a monthly basis. It serves as a simplified return form, allowing taxpayers to declare their tax liabilities and pay taxes accordingly.

GSTR – 4 Composition Taxpayer

GSTR-4 is a quarterly return that needs to be filed by taxpayers registered under the Composition Scheme in India under the Goods and Services Tax (GST) regime. The Composition Scheme is an alternative method of taxation available to small taxpayers with a turnover below a certain threshold.

Here are some key points about GSTR-4:

- Frequency: GSTR-4 is filed on a quarterly basis. Taxpayers under the Composition Scheme need to file this return by the 18th of the month following the end of the quarter.

- Contents: The return captures details of outward supplies, inward supplies attracting reverse charge, and tax payable by the taxpayer during the quarter.

- Simplified Form: GSTR-4 is relatively simpler compared to other GST returns. It consists of fewer details and is designed to suit the needs of small taxpayers.

- Eligibility: Taxpayers with a turnover up to a specified threshold (currently ₹1.5 crores in India) can opt for the Composition Scheme and file GSTR-4.

- Payment of Tax: Under the Composition Scheme, taxpayers pay tax at a fixed rate on their turnover. They are not eligible to claim input tax credit.

It’s important for taxpayers registered under the Composition Scheme to ensure timely and accurate filing of GSTR-4 to comply with GST regulations.

GSTR – 5 Non Resident Taxpayer

GSTR-5 is a GST return that is required to be filed by non-resident foreign taxpayers who are engaged in supplying goods or services in India and do not have a fixed place of business in the country. It is a periodic return filed under the Goods and Services Tax (GST) regime in India.

Here are some key points about GSTR-5:

- Frequency: GSTR-5 is filed on a monthly basis. Non-resident taxpayers are required to file this return by the 20th of the following month.

- Contents: The return includes details of outward supplies, inward supplies attracting reverse charge, amendments to previously filed returns, and the amount of tax payable.

- Information Required: Non-resident taxpayers need to provide details of their supplies made in India, tax payable on those supplies, and any adjustments or amendments to previously filed returns.

- Tax Payment: Non-resident taxpayers are required to pay the tax due on their supplies made in India at the time of filing GSTR-5.

- Penalties: Failure to file GSTR-5 or filing it late can attract penalties under GST laws.

GSTR – 6 Input Service Distributor

GSTR-6 is a GST return that is filed by Input Service Distributors (ISDs) in India under the Goods and Services Tax (GST) regime. Input Service Distributors are businesses that receive invoices for input services and then distribute the input tax credit (ITC) to the recipient branches or units of the same business.

Here are some key points about GSTR-6:

- Frequency: GSTR-6 is filed on a monthly basis. ISDs are required to file this return by the 13th of the following month.

- Contents: The return includes details of input tax credit received by the ISD and distributed to its branches or units. It also includes details of invoices received and distributed during the reporting period.

- Input Tax Credit Distribution: ISDs are responsible for distributing the input tax credit (ITC) available on input services to the recipient units of the same business. GSTR-6 captures the details of this distribution.

- Adjustments: If there are any adjustments or corrections to be made to the input tax credit distributed in previous periods, they can be reported in the GSTR-6 return.

- Late Fees: Failure to file GSTR-6 or filing it late can attract penalties under GST laws.

GSTR – 7 TDS on GST

GSTR-7 is a GST return that is filed by taxpayers who are required to deduct tax at source (TDS) under the Goods and Services Tax (GST) regime in India. This return is applicable to Tax Deductors (deductors) who deduct TDS while making payments to suppliers for certain specified goods or services.

Here are some key points about GSTR-7:

- Frequency: GSTR-7 is filed on a monthly basis. Deductors are required to file this return by the 10th of the following month.

- Contents: The return includes details of TDS deducted by the taxpayer, details of the deductee (supplier), and other relevant information required for TDS compliance.

- Input Tax Credit: The TDS amount deducted and reported in GSTR-7 by the deductor is reflected in the electronic cash ledger of the deductee (supplier). The supplier can utilize this amount for payment of their tax liability.

- Adjustments: Any corrections or adjustments to TDS details reported in previous periods can be made in the subsequent GSTR-7 returns.

- Late Fees: Failure to file GSTR-7 or filing it late can attract penalties under GST laws.

GSTR – 8 TCS on GST

GSTR-8 is a GST return that is filed by e-commerce operators in India under the Goods and Services Tax (GST) regime. E-commerce operators are required to collect tax at source (TCS) from the payments made by customers to sellers on their platform and remit it to the government. GSTR-8 is the return through which e-commerce operators report the details of such transactions and the TCS collected.

Here are some key points about GSTR-8:

- Frequency: GSTR-8 is filed on a monthly basis. E-commerce operators are required to file this return by the 10th of the following month.

- Contents: The return includes details of supplies made through the e-commerce platform, including the GSTIN (Goods and Services Taxpayer Identification Number) of the supplier, the amount of TCS collected, and other relevant information.

- Input Tax Credit: The TCS amount collected by the e-commerce operator and reported in GSTR-8 is reflected in the electronic cash ledger of the supplier. The supplier can utilize this amount for payment of their tax liability.

- Adjustments: Any corrections or adjustments to the TCS details reported in previous periods can be made in the subsequent GSTR-8 returns.

- Late Fees: Failure to file GSTR-8 or filing it late can attract penalties under GST laws.

GSTR – 9 Annual Return

GSTR-9 is an annual return that is filed by regular taxpayers registered under the Goods and Services Tax (GST) regime in India. It provides a summary of all the GST returns filed during the financial year. GSTR-9 is essentially a consolidation of the monthly or quarterly returns filed throughout the year.

Here are some key points about GSTR-9:

- Frequency: GSTR-9 is filed annually. Taxpayers are required to file this return by the 31st of December following the end of the financial year.

- Contents: The return includes details of outward and inward supplies, input tax credit claimed, taxes paid, and other relevant information for the entire financial year.

- Reconciliation: GSTR-9 serves as a reconciliation statement where taxpayers reconcile the data reported in their regular returns (GSTR-1, GSTR-3B, etc.) with the annual financial statements.

- Late Fees: Failure to file GSTR-9 or filing it late can attract penalties under GST laws. However, it’s important to note that late fees for GSTR-9 filings have been waived for the financial years up to 2019-20.

- Audit Requirement: Taxpayers with a turnover above a specified threshold (currently ₹2 crores) are required to get their annual accounts audited by a Chartered Accountant or a Cost Accountant. In such cases, they need to file GSTR-9 along with the audited annual accounts and a reconciliation statement (GSTR-9C).

Practical in Govt. Portal

Learners interested in the Accounting, Finance, MIS, Data Analysis, Tax, and Business Management Sectors should consider enrolling in the GST course. Keeping up with the requirements of the GST has become much easier thanks to software, and this improvement is also covered in training.

The course is divided into various modules that go over the requirements of the GST, how to apply for a registration number, and how to complete various forms. The most important module is the third, which explains how to complete the different applications and documents needed to file for GST.

Tally GST TDS & ITR Professional Certification Course Online/ F2F

- Tally Software, Busy Software

- GST Registration & Various form discussion and return submission

- GST refund and return process

- GSTR 1 to 11

- GST Computation & Problem Solve

- Debit and Credit

- GST refund against Export and SEZ supply

- GST Annual Return

- Tax Audit compliance

- Professional tax calculation and filling return

- Online TDS filling

- TDS , Advance Tax, Self Assessment Challan

- IT Registration with various form discussion & return process

- IT (ITR 1 to ITR 6)

- ROC Compliance

- Advance Excel

- Advance Word

- Digital Marketing